Download the Faculty Financial Statement Guide

Total Recap

The Total Recap page provides faculty with the overall account balance, including actual expenses that have been incurred, projected expenses that are to come and estimated balance. It will also include general comments for additional context or clarification to the financial statement.

- Fund/Project Description: This area identifies the name or description of the fund or project (Ex: Incidentals). There is also information here to help identify the specific Fund Code and Project Code, two very important details of the full Chart of Accounts (COA) that is required when submitting a purchase or reimbursement request. If there is an expiration date associated with a specific fund, it will also be listed here.

- Actuals: This area shows the faculty’s full balance. Listed here are:

- Fiscal Year Starting Budget: the carryforward balance from the previous year. (NOTE: negative numbers indicate a debit)

- New Allocation: any new funding being allocated.

- Fiscal Year Expense: the actual expenses that have applied against your funds and categorized in the following groups (NOTE: negative numbers indicate a credit for these expenses):

- Personnel Expense: these are salary and benefits expenses associated with a student, staff and/or other personnel types (does not include independent contractors).

- Supplies and Services: all expenses related to purchases of office/lab supplies and or services. (ex: Office Supplies, Books and Maps, Cleaning Supplies, Subscriptions, etc.)

- Travel and Operating Expenses: all expenses related to travel (flights, vehicle rentals, mileage reimbursement, conference) and operating expenses (event coordination, food and beverage, catering, service agreements) are totaled here.

- Recharge Sales and Services: all expenses related to internal recharge such as campus catering, mail services, and parking.

- Other Expenses: the other expenses are more non-traditional expenses that a faculty member might incur. These include utilities, financial aid and scholarships, and campus foundation grants.

- Total Expense: this is the total of all actual expenses from the categories in the Fiscal Year Expense section.

- Total Actuals: The balance after calculating the total actuals from the starting budget and any new allocations. (NOTE: negative numbers indicate an overdraft)

- Projected: This section of the financial statement shows known projected expenses that are expected to come in but have not applied against the actual account. The projected expenses are estimates based on the purchase and/or reimbursement request received by the Financial Service Analyst. Every effort is made to keep as close to accuracy of the projected expense, but actual expense may differ slightly due to tax or the inclusion/exclusion of expense items. Expenses listed here have been encumbered to show and prevent overspending within the specific account.

- Projected Balance through End of FY: This row shows the projected overall balance, with consideration of both actual and projected expenses, through the end of the fiscal year. (NOTE: negative numbers indicate a projected overdraft)

- Projected Expenses: The purpose of this table is to display the known projected expenses that are currently pending. These are expenses that have been reviewed by the Financial Service Analyst and approved as encumbered expenses. Expense amounts listed here automatically feed into the Projected section of the financial statement based on the following sections:

- Expense Type: This determines the category of expense such as personnel, supplies, travel, etc.

- Project Name: Identifies the specific fund/project location the expense is being applied to.

The Expense Notes section is there to provide context of what the expense is for. This helps with reconciliation once the projected expenses have been processed.

- General Notes: These blank spaces are used to provide general notes or context regarding the financial statement or a specific fund/project. The Financial Service Analyst will often provide notes in these areas to help give context, flag a potential issue, or share general comments.

Faculty Financial Statement Workbook Tabs

The financial statement provided is part of a larger Excel workbook, containing several different types of reports and/or tools. Some may be very useful as a reference to specific types of expenses whereas others may exist largely as a tool used by the Financial Service Analyst for reporting and reconciliation. Below are descriptions of a few key reports but there may be other ad hoc reports provided that may be unique to a specific faculty member. Reports defined below may not necessarily be provided and are based on faculty expenditures.

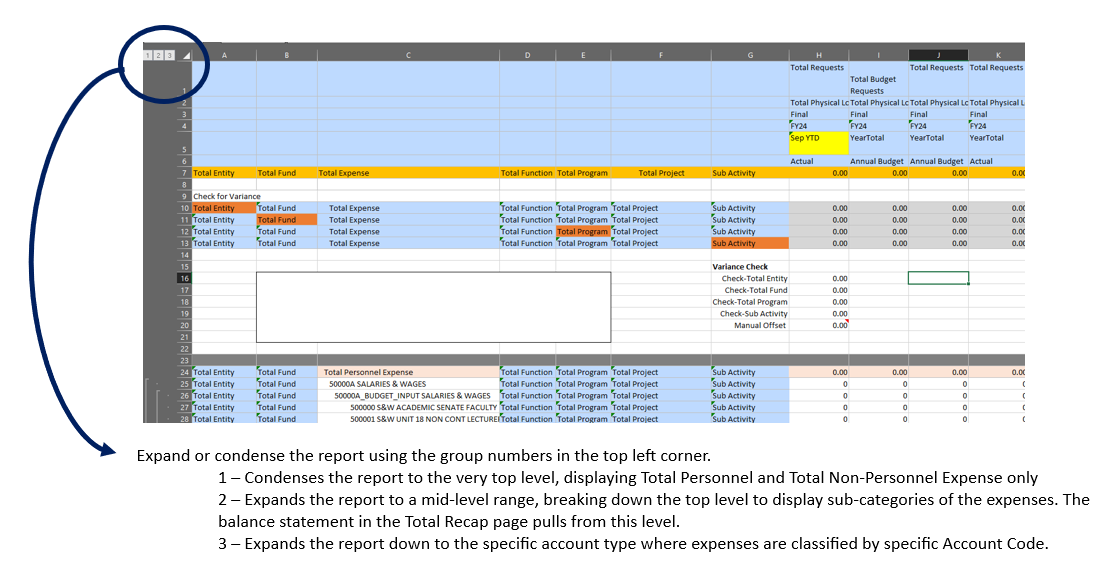

SV_Sandbox: The SmartView Sandbox tab provides a tool that is utilized by the Financial Service Analyst to investigate any discrepancy in a specific account or to validate the actual expense and budget.

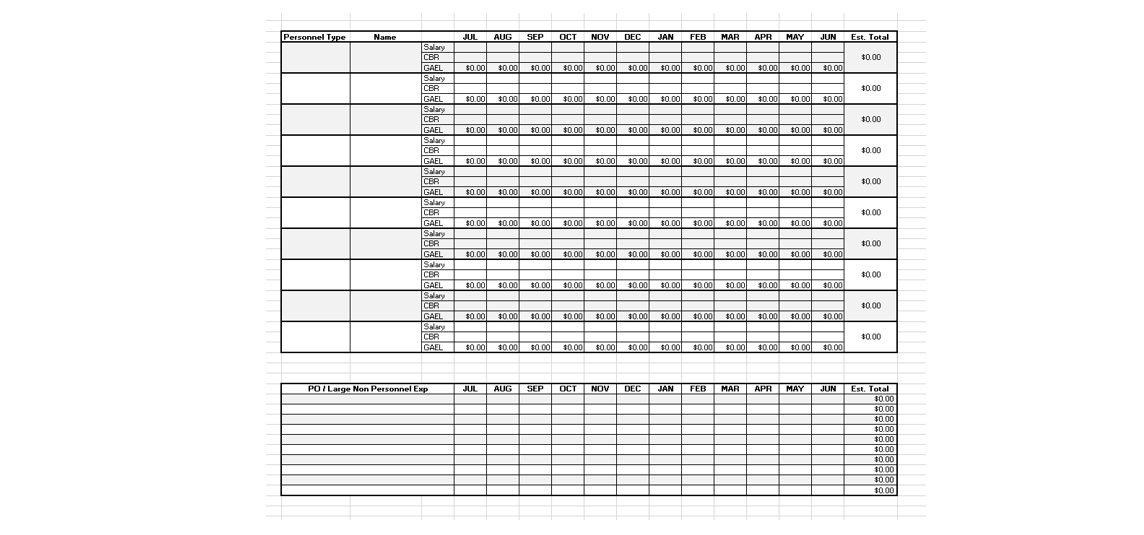

Projections: The Projections tab allows for the Financial Service Analyst to project out personnel expenses throughout the fiscal year. The projections tab provides what type of personnel and how much is being projected for a specific month. In addition to personnel, other larger expenses, paid over a period, may also be projected here. Examples of these include Independent Contractors, equipment, and large contracts.

Total Recap: The Total Recap tab is the faculty’s primary page, displaying the full overview of their budget and expenses. See the Total Recap section for more information.

SmartView Reports: These SmartView reports can be identified by the unique naming conventions applied on each report. Each tab name includes the first 3 characters and last set of numbers of the faculty’s Project Code and the Fund Code.

Ex: Project Code: INT0000999 & Fund Code 19900 = INT999-19900

These SmartView reports are very large and pull from the General Ledger to display actual expenses. The Financial Service Analyst will update this report every month to view expenses and budgets as well as update the main balance sheet on the Total Recap page.

DOPE Report: A Distribution of Payroll Expense (DOPE) report is provided as a reference when there are personnel expenses. DOPE reports provide the faculty with the specific salary and benefit of each staff member, student, GSR, postdoc, or other type of personnel being paid on the faculty account.

GL or GL Data Report: The General Ledger (GL) report displays all expenditures that have been processed and applied against a specific fund/project. The expenditure total should match the total expense line on the financial statement for the specific fund.

Additional Guidance

For further guidance or specific questions about the Faculty Financial Statement, faculty are encouraged to contact their Financial Service Analyst or email soe-financials@ucmerced.edu.